Mitigate risks with informed decisions

Consolidate information from disparate sources including ETRM, CTRM, spreadsheets and market data providers, to create an accurate view of risk. Get insights into market risk and make more informed decisions. Take necessary mitigation measures.

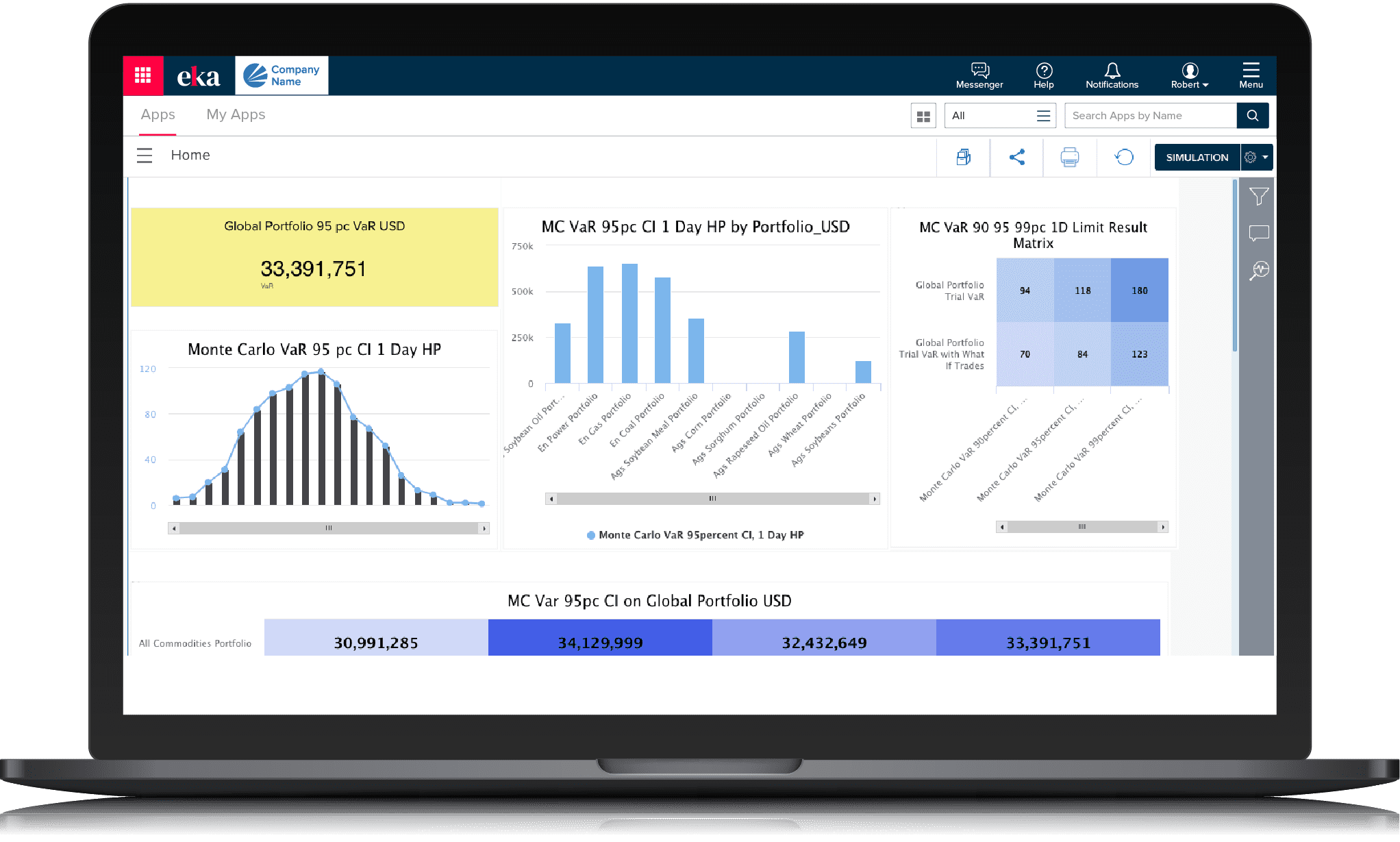

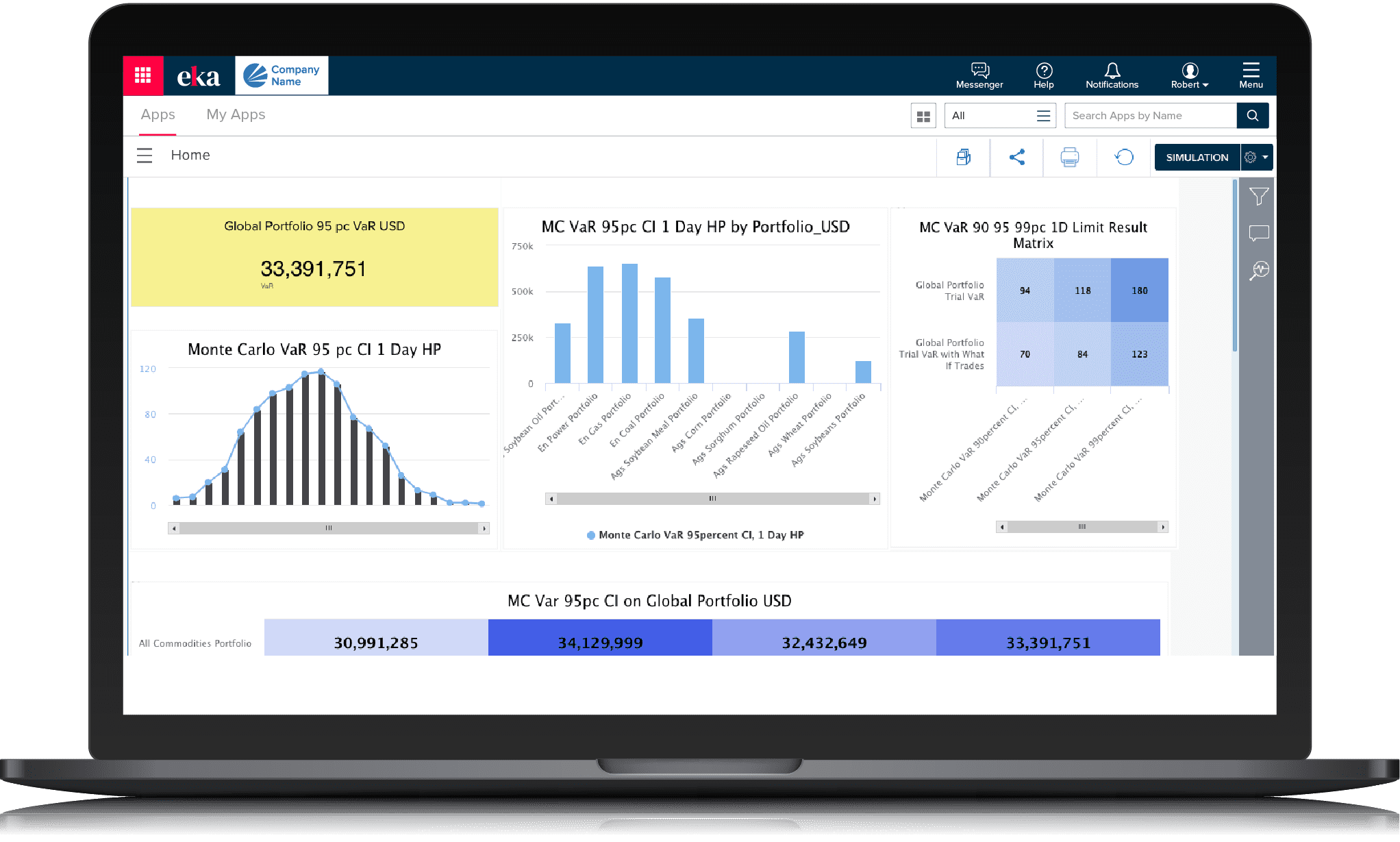

Have flexibility in maintaining portfolio. Calculate VaR for portfolios and sub-portfolios together or separately.

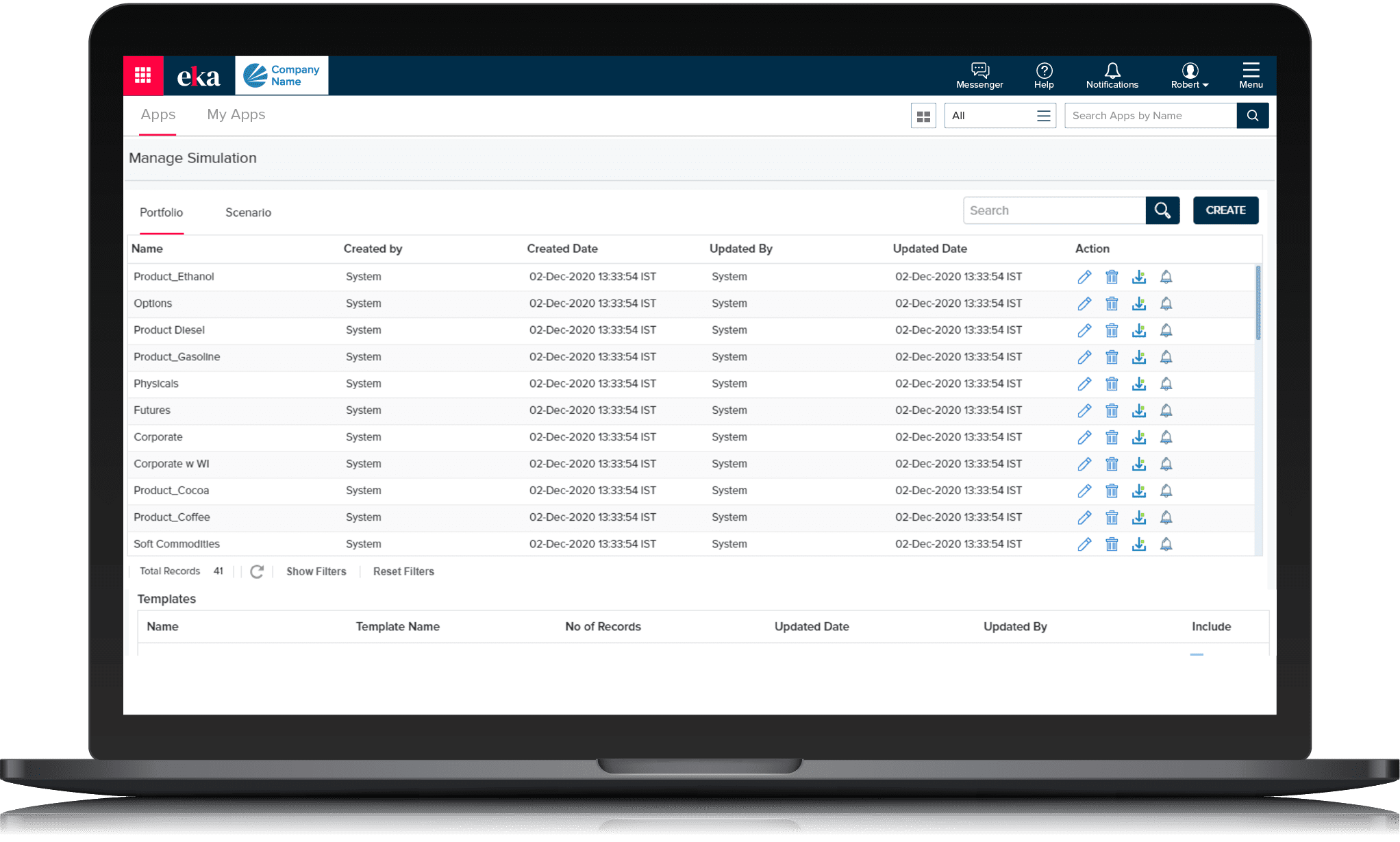

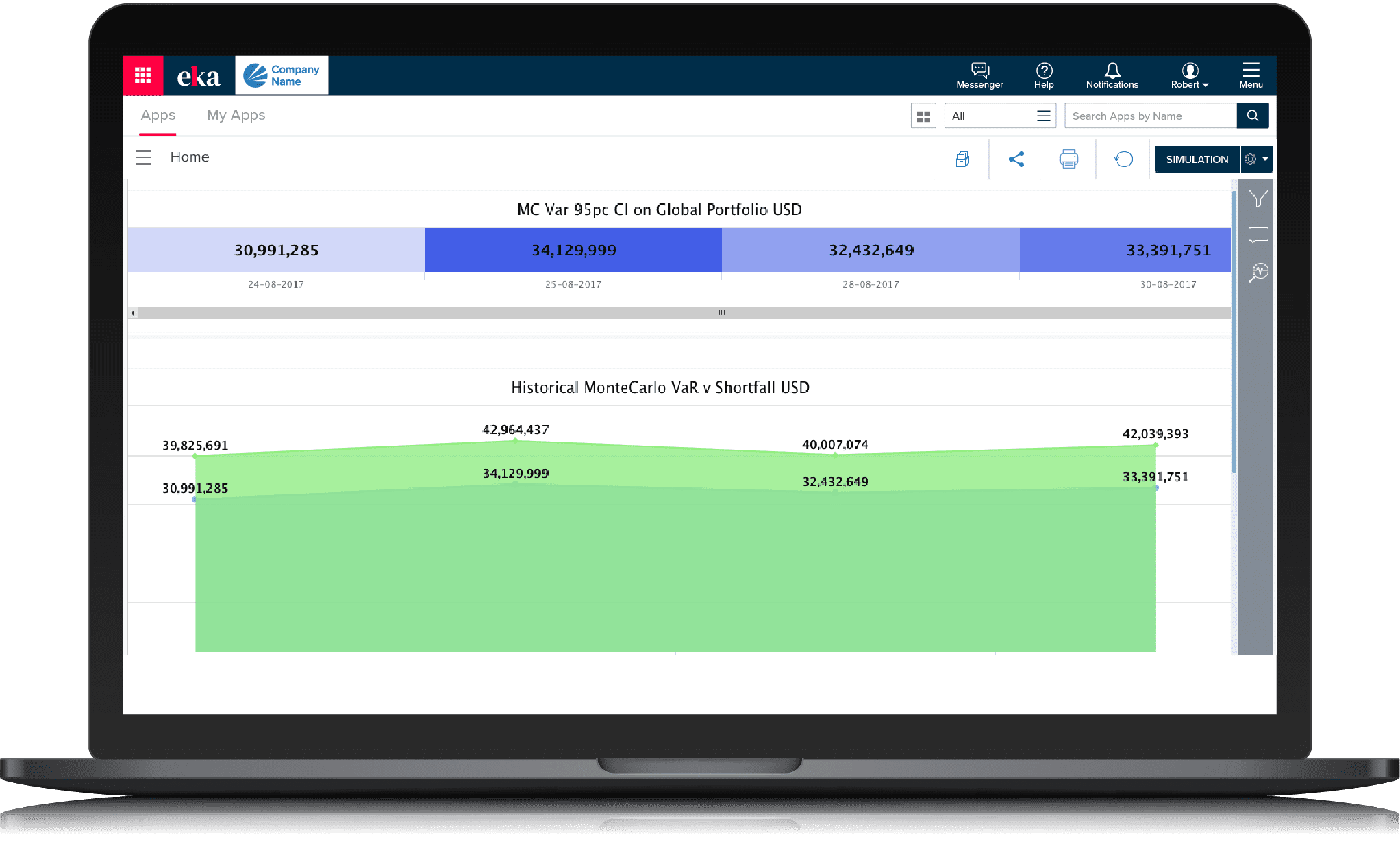

Compute VaR using any of the three methods- Monte Carlo, Analytical and Historical methods. Run simulations on portfolio/scenario combination and compare results.

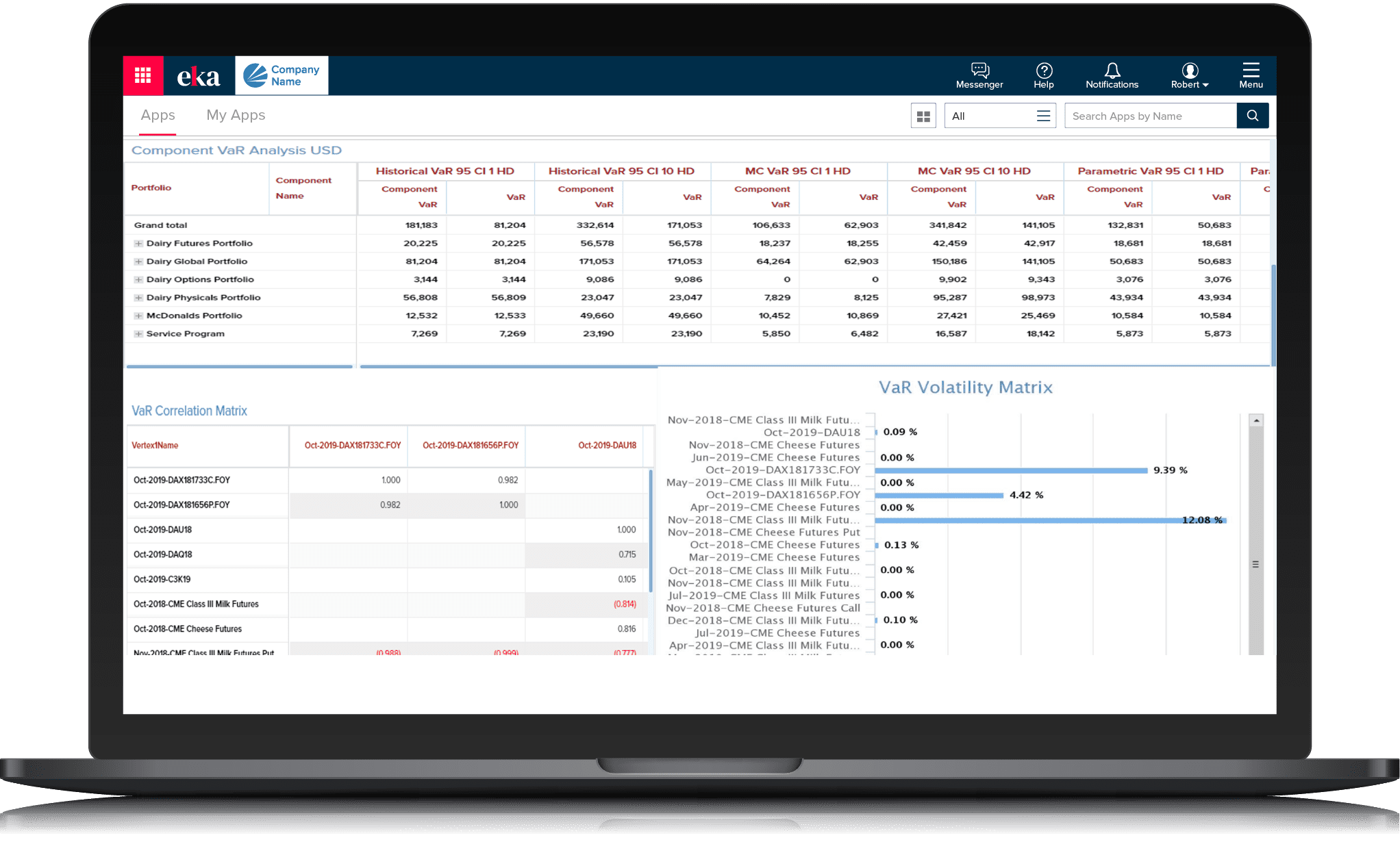

Perform component VaR and other calculation like Volatility and Correlation.

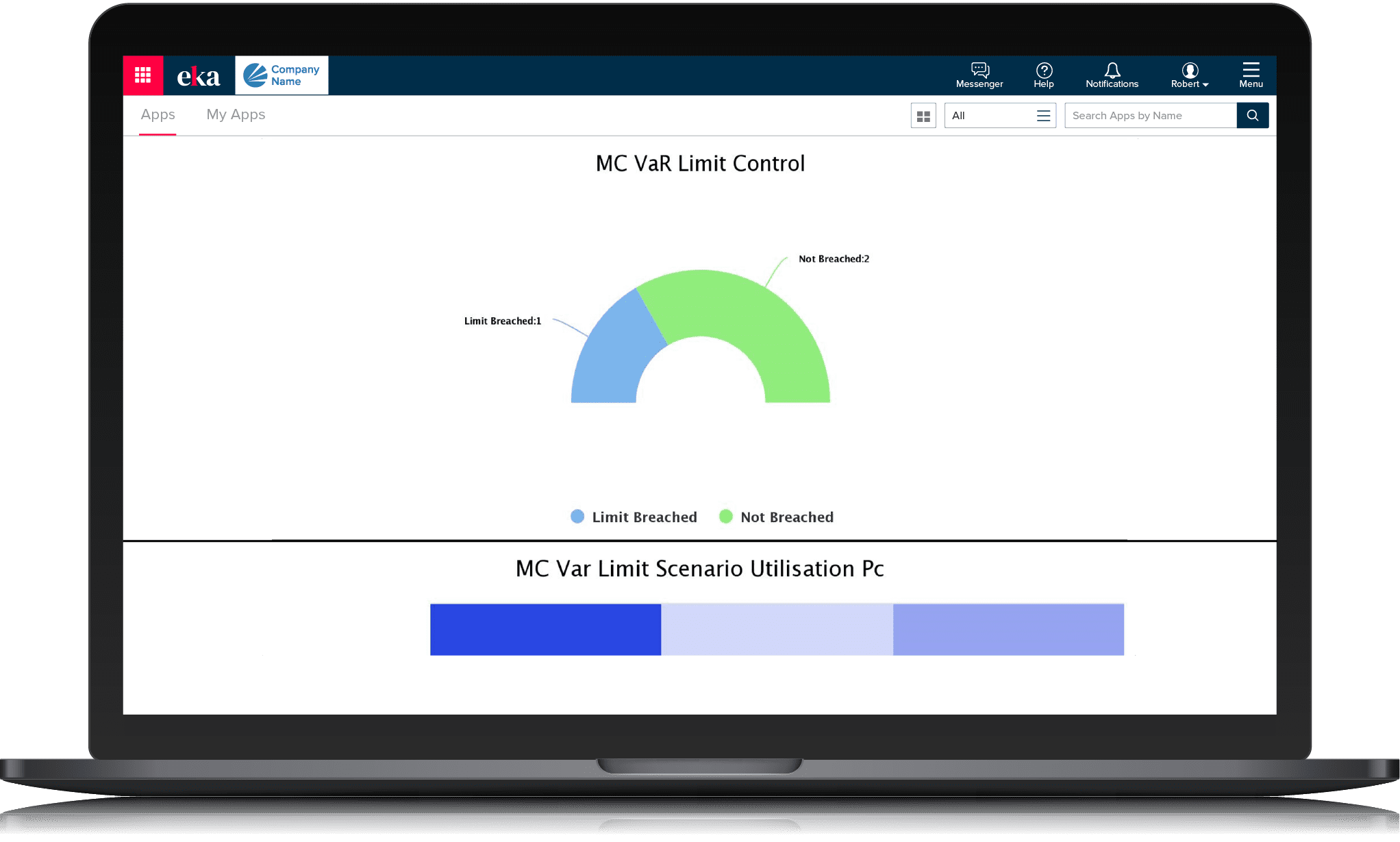

Monitor the hard and soft risk limits set on the VaR results to check on hard and soft risk breaches and see utilization.

Identify correlations and volatility between different market curves, interest rates and exchange rates to gain deeper insights into market risk.

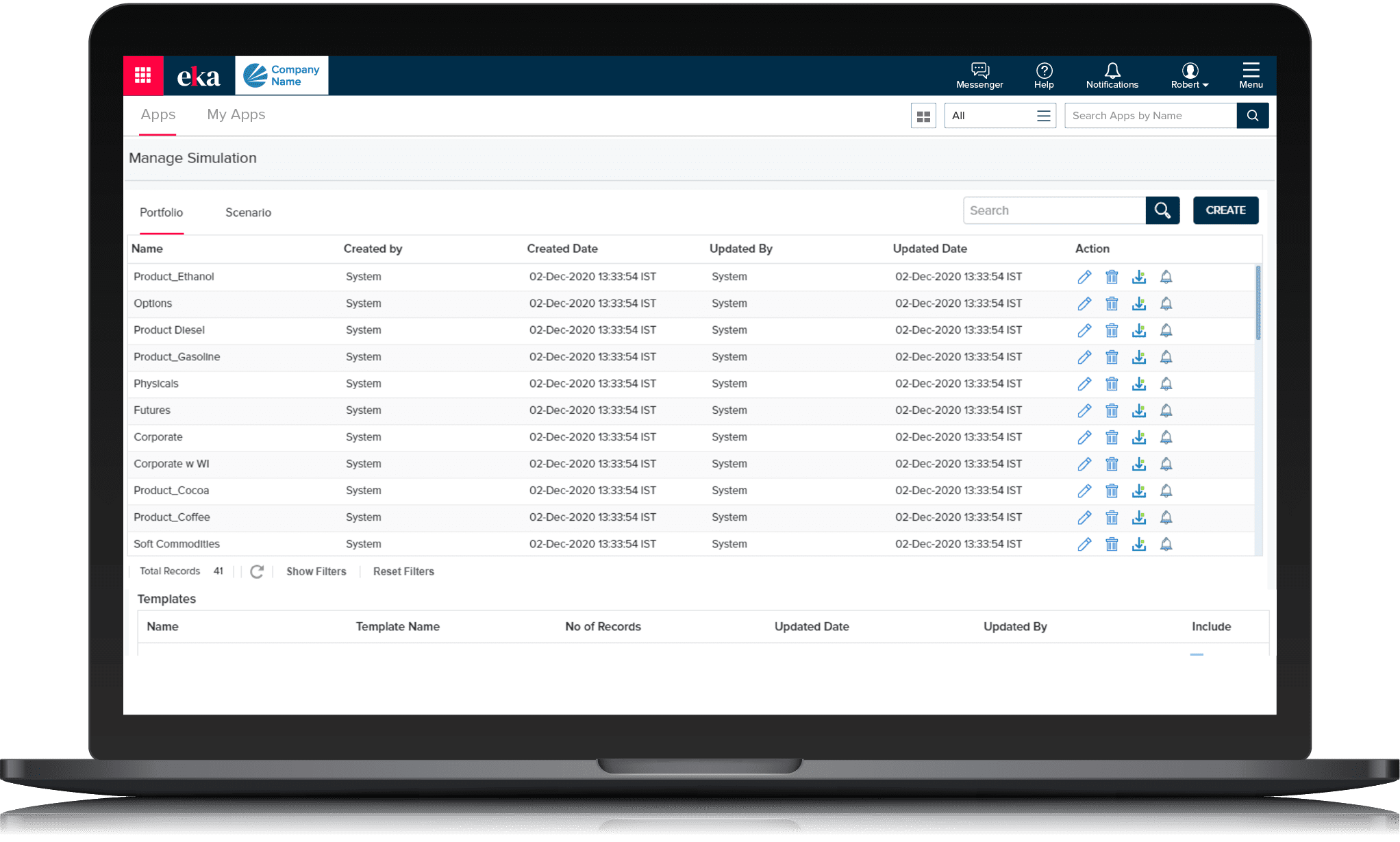

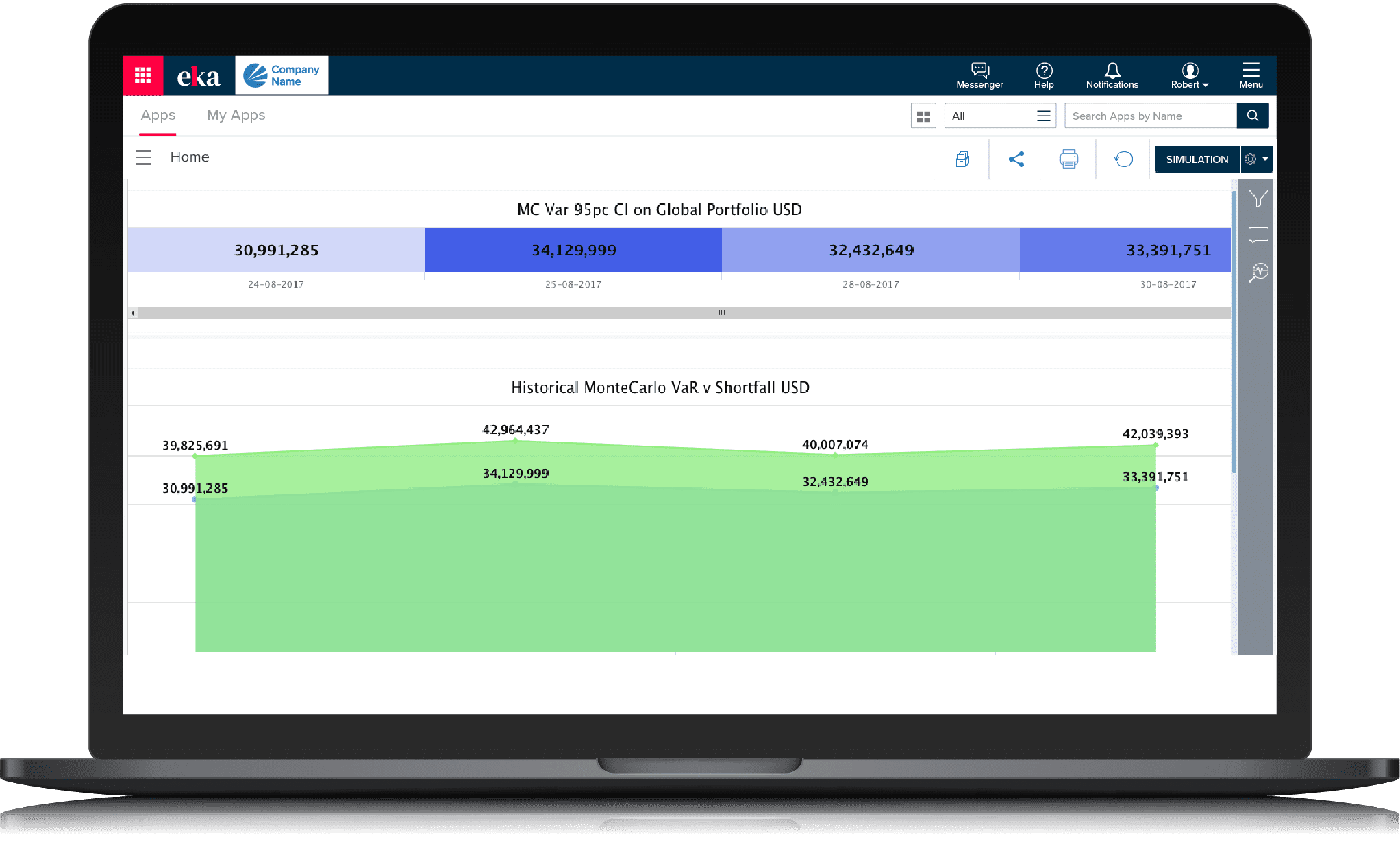

Have flexibility in maintaining portfolio. Calculate VaR for portfolios and sub-portfolios together or separately.

Compute VaR using any of the three methods- Monte Carlo, Analytical and Historical methods. Run simulations on portfolio/scenario combination and compare results.

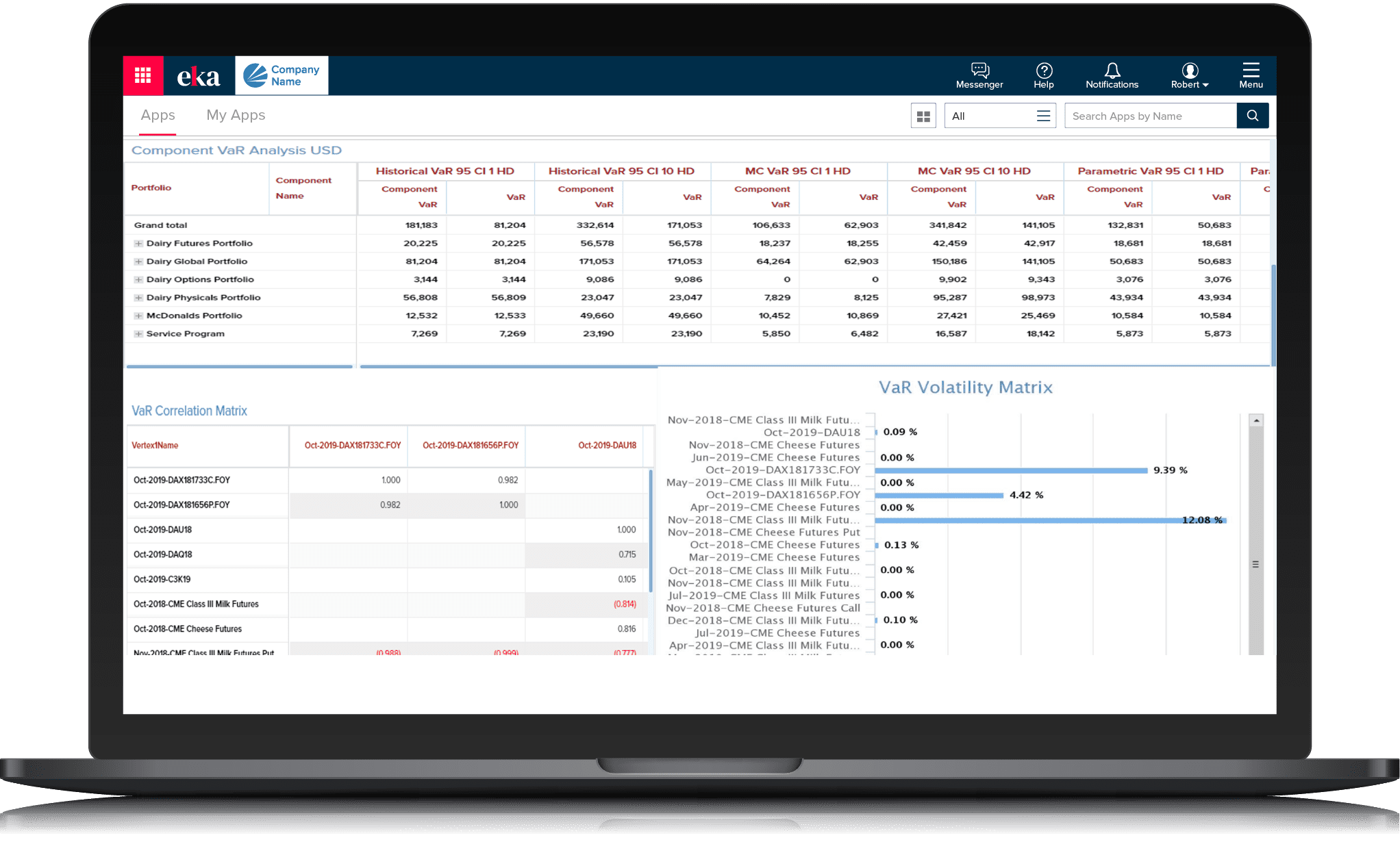

Perform component VaR and other calculation like Volatility and Correlation.

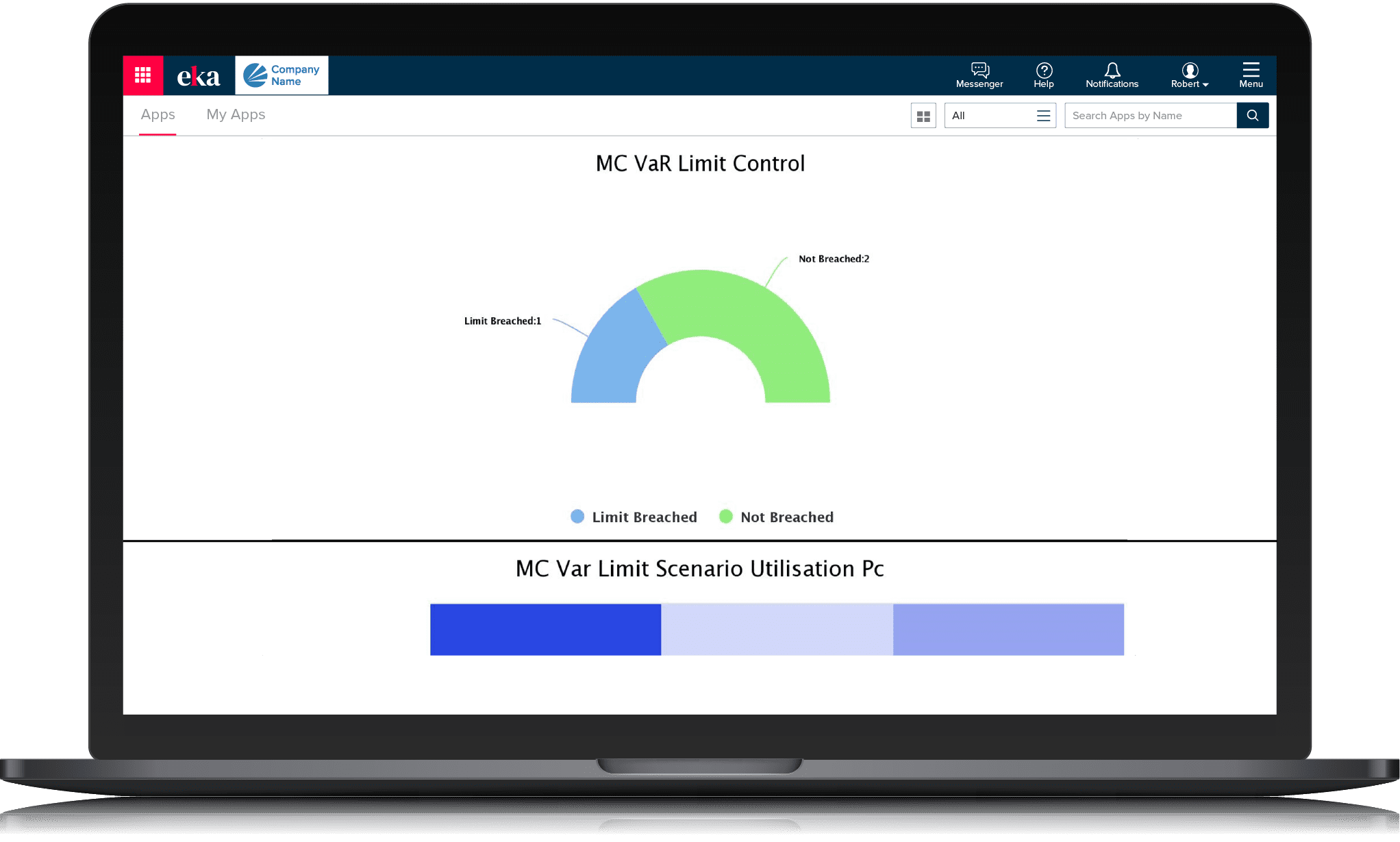

Monitor the hard and soft risk limits set on the VaR results to check on hard and soft risk breaches and see utilization.

Identify correlations and volatility between different market curves, interest rates and exchange rates to gain deeper insights into market risk.

Trusted by 100+ global businesses

Achieve better business outcomes

Credit risk

Assess the counterparty credit risk and provide a single point of truth on credit risk exposure with Eka’s Credit Risk app.

Risk and monitoring

Analyze global risk across multiple portfolios and books with Risk and Monitoring app. Managing risk is one of the most crucial and complex challenges for commodity companies.